Ross Stores, Inc. (ROST) operates two brands of off-price apparel retailers. Ross Dress for Less is the larger of the two and is also the largest off-price apparel chain in the United States, offering consumers discounts of 20% to 60% off brand name and designer clothing, accessories and footwear. The other, dd's DISCOUNTS, is a smaller subsidiary and targets customers with more moderate income compared to Ross customers, according to the company's most recent 10-K filing. The two subsidiaries make up 1,627 stores combined. In a sector that is under pressure from online retailers, mainly Amazon (AMZN), Ross Stores has been posting some impressive growth numbers and continually expanding their exposure to the market. And as the markets start to recover from the correction in early February, ROST shares may be in a prime position to grab at a discount.

Earnings have been good in a tough sector

Ross Stores, Inc. will report their Q4 and FYE earnings report on Tuesday, March 6. Over the last few years, they've performed exceptionally well, especially in a sector that is getting increasingly difficult to compete in. Over the last 3 years, ROST has an average YoY increase in revenue of 8%. This success is attributed to the company's understanding of the growing e-commerce industry and their ability to adapt by "pursuing and refining our existing strategies and by continuing to strengthen our organization, diversify our merchandise mix and more fully develop our systems to improve regional and local merchandise offerings." This is according to the company's FY2017 10-K filing here.

ROST has been able to consistently beat top and bottom line estimates by a large percentage as well. They've had a positive revenue and earnings surprise in all of the last 9 quarters with the exception of Q1-16. Those top line surprises came at an average of 1.5% and trickled down to the bottom line as EPS surprises have come at an average of 4.9%. Although these surprises probably come as a mix between analysts being conservative in a sector that has to compete with the behemoth that is Amazon, and a company in ROST that is truly dedicated to keeping operating costs low while following an expansion plan to gain more exposure to the marketplace.

ROST strives to cut costs

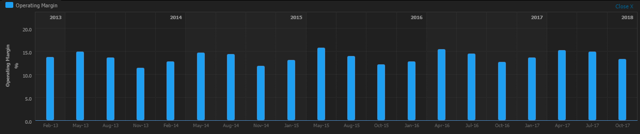

According to that same filing, ROST strives to keep operating costs as low as possible. This is evident in their operating margins of 13.58% which is double the industry average of 6.94%. The company has been able to keep this number steady around 13% for the last 4 years which confirms the company's dedication to their plan. They achieve this by creating a self-service retail format inside their stores which keeps SG&A costs lower as well compared to full-price department stores such as Target (TGT) and Walmart (WMT).

(Source: Thomson Reuters Eikon)

(Source: Thomson Reuters Eikon)

The company's execution is prevalent in the Net Margins. ROST has posted an average net margin of 8.6% over the last 4 years. Compared to the industry average of 3.2% over that same period, this is exceptional and a direct result of the dedication to the company's operational plans.

Continued store expansion

Ross Stores has clearly been driven towards increasing marketplace exposure through their expansion of store locations. Since 2013, the company has opened an average of 90 stores per year. Between Q1 and Q3 of their 2017 fiscal year, they've already opened 96 stores. This number should be even higher once they announce their Q4 earnings in two weeks. It doesn't seem like the company is planning to stop this expansion either as in the month of February 2018 alone, the company has announced 13 additional openings.

(Source: Thomson Reuters Eikon)According to the company's 2017 annual report, their real estate strategy for the year consisted of opening new locations in markets where the brand was already established in order to reduce the cost of overhead and advertising expenses. This has worked well as operating margins have remained higher than the average.

(Source: Thomson Reuters Eikon)According to the company's 2017 annual report, their real estate strategy for the year consisted of opening new locations in markets where the brand was already established in order to reduce the cost of overhead and advertising expenses. This has worked well as operating margins have remained higher than the average.

One thing to keep an eye on when the 2018 annual report comes out is whether or not the company sticks with this strategy or starts to break into markets where they are less exposed. I believe that with the amount of expansion they've done over the last few years, the company should start to break into less exposed markets in the coming years to enhance their brand and start bringing in new customers.

Undervalued

ROST has a P/E of 25.20, a forward P/E of 20 and a PEG of 1.67. The average industry ratios are a P/E of 28.6 and a forward P/E of 17.1. For a company like ROST that has been expanding so rapidly while consistently blowing past earnings estimates, they are grossly undervalued to the industry. With the growth that the company has already shown, a PEG as low as 1.67 signals that there is still plenty of upside potential.

Another thing worth noting is the company's EBITDA continues to grow YoY at a good pace. 2016 showed an increase of 10.33% followed by 10.84% in 2017 and consensus for the upcoming 2018 report is 11.52%. The EV/EBITDA ratio is 13.0 for ROST which is well above the average of 8.5.

Positive sentiment going forward

According to analysts, ROST is expected to continue to produce for its shareholders going forward. As stated earlier, the company will announce its Q4 and FYE earnings on March 6. Expectations are high as EPS is estimated to increase 20.42% for Q4 and 16.15% for the year. Other numbers of interest include revenue estimates for the year at 9%, EBITDA to 11.5%, and net income to grow 16.15%. Because of these estimates going forward, we've seen a number of price target upgrades so far this year from the likes of Bernstein, Deutsche Bank, Wells Fargo, UBS and Citigroup. Each of them revising targets to $100, $95, $91, $81 and $85 respectively.

There are currently 23 analysts covering ROST and 100% of them are positive with 7 being a HOLD, 10 at BUY ratings and 6 STRONG BUYs. The average target amongst them is $84.48. This leaves shares with a 7% upside to their estimates.

Technicals support a low risk entry at current price

As seems to be the case with most stocks recently, ROST shares have pulled back from its recent highs due to the February market correction. But as stocks start to gain some momentum again, they've allowed for a lot of buying opportunities. Ross Stores is no different. Shares were pulled down to their trend line support during the correction but have since started to bounce off of that support and look to be heading higher again. The price is currently below the short term moving averages but I don't see this as being a strong enough resistance to hold them down with anticipation of a good earnings report. Since the shares are sitting just slightly higher than the support of the trend line, this provides a low risk entry and should be taken advantage of as the company is expected to outperform its estimates once again.

(Source: Thomson Reuters Eikon)

(Source: Thomson Reuters Eikon)